Amity Business School, Amity University, Gwalior, Madhya Pradesh, India.

Corresponding author email:pjain1203@gmail.com

Article Publishing History

Received: 21/05/2024

Accepted After Revision: 25/07/2024

The adoption of blockchain technology in the banking sector has gained significant attention due to its potential to improve operational efficiency, transparency, and security. The study aims to investigate how the relative advantage, compatibility, complexity, observability, and trialability of blockchain, as proposed by Rogers’ theory, impact the adoption behavior of private sector banks in India. The study was employed a mixed-methods approach, including a quantitative survey and qualitative interviews, to collect data from relevant bank employee in the banking industry. According to the findings of the study, relative advantage, compatibility, observability, and trialability all have a major impact on usage behaviour and the adoption intention of blockchain technology in private banks. The study also discovered that the complexity of deploying and integrating blockchain technology into banking procedures and systems may have a detrimental influence on bank adoption behaviour.

Blockchain adoption, Innovation diffusion theory, Usage behavior, Artificial Intelligence

Jain P. Examining Blockchain Adoption and Usage Behavior in Private Banks in India: An Empirical Study Based on Rogers' Diffusion Theory. SSN Journal of Management and Technology Research Communications. 2024;1(1).

Jain P. Examining Blockchain Adoption and Usage Behavior in Private Banks in India: An Empirical Study Based on Rogers’ Diffusion Theory. SSN Journal of Management and Technology Research Communications. 2024;1(1). Available from: <ahref=”https://shorturl.at/tPzZO“>https://shorturl.at/tPzZO</a>

INTRODUCTION

By improving operational effectiveness, raising security, and reducing costs, blockchain technology has the potential to revolutionize the banking sector (1). Like in many other countries, private sector banks in India are starting to show interest in utilizing blockchain’s advantages. However, the implementation of blockchain technology in the banking sector is complicated and challenging, taking into account a number of factors that affect bank behavior and decision-making (2). The innovation diffusion theory by Everett Rogers provides a framework for comprehending how innovations are embraced and dispersed in a social system. According to the theory, relative advantage, compatibility, complexity, observability, and trialability are some of the key factors that affect whether an innovation is adopted.

These elements may affect adopters’ perceptions, choices, and actions, which in turn may affect the pace and scope of adoption (3). In recent years, blockchain technology has become more and more significant in a range of field of banking sector. Blockchain may be used, for instance, to automate procedures, analyze data, offer insights, and support decision-making, which may affect how people view the relative benefit, complexity, and observability of blockchain technology (2, 3). In light of this, the research suggests using the innovation diffusion theory to examine the adoption of blockchain by private sector banks in India (4).

This study aims to examine the effects of Rogers’ theory’s suggested variables on the adoption behavior of India’s private sector banks, including relative advantage, compatibility, complexity, observability, and trialability. By incorporating the innovation diffusion framework, this study aims to provide a comprehensive understanding of the dynamics perception of blockchain adoption in the banking sector and throw light on how blockchain influences the behavior of private sector banks in India (4, 5). Overall, this research can add to the body of knowledge about innovation diffusion and blockchain acceptance in banks. The study’s findings may have significance for policymakers, practitioners, and researchers interested in boosting blockchain technology adoption in private sector banks in India and elsewhere.

Blockchain Adoption for Banks

Blockchain technology is a distributed ledger that offers safe, transparent, and immutable

recordkeeping. Banks can use blockchain in a variety of ways:

- Payments & Remittances: By removing intermediaries, lowering costs, and enhancing transaction speed, blockchain can streamline cross-border payments and remittances (4).

- Identity Verification: Blockchain has the potential to improve identity verification procedures by providing a decentralized and safe mechanism to store and verify consumer IDs, hence reducing fraud and increasing security (4).

- Smart Contracts: Smart contracts based on blockchain technology can automate and streamline complicated operations such as loan agreements, trade financing, and insurance claims, decreasing the need for middlemen and enhancing efficiency (6).

Know Your Client (KYC) Compliance: By securely storing client data and enabling data sharing among banks while preserving privacy and data protection, blockchain can simplify and streamline KYC compliance (7). Blockchain can improve supply chain finance by offering end-to-end visibility and transparency, decreasing fraud, and enhancing trade finance efficiency (8).

Blockchain Technology and Innovation Diffusion Theory: Everett Rogers’ innovation diffusion theory explains how innovations are adopted and spread within a social system. The qualities of an innovation, according to the innovation diffusion theory, impact its acceptance (9). Blockchain technology offers distinct qualities that may influence its acceptance in banks, including decentralization, transparency, and immutability. These qualities can influence how banks perceive the benefits and hazards of implementing blockchain technology, and so influence its adoption within the banking industry (10).

For the acceptance of innovations, the innovation diffusion theory offers a five-stage process: knowledge, persuasion, choice, implementation, and confirmation. When exploring and deploying blockchain technology, banks may go through these stages (10). Banks, for example, may become aware of blockchain technology and its potential benefits during the knowledge stage. Banks may examine the benefits and drawbacks of adopting blockchain technology during the persuasive stage. Banks may choose to accept or reject blockchain technology during the decision stage. Banks may install blockchain solutions during the implementation stage, and banks may evaluate the results of their adoption efforts during the confirmation step (11).

The relationship between blockchain technology and the innovation diffusion theory entails taking into account the characteristics of the invention, the adoption process, adopter categories, communication channels, and the social structure in which banks operate (6, 12). This research can shed light on how and why blockchain technology might be adopted and spread inside the banking industry.

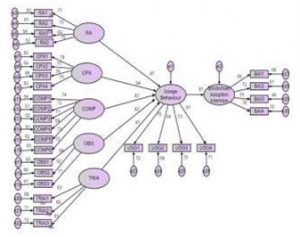

Figure 1: Conceptual Model

Literature Review And Hypothesis Development: Everett Rogers’ innovation diffusion theory explains how innovations are adopted and spread within a social system. The qualities of an innovation, according to the innovation diffusion theory, impact its acceptance (9). Blockchain technology offers distinct qualities that may influence its acceptance in banks, including decentralization, transparency, and immutability. These qualities can influence how banks perceive the benefits and hazards of implementing blockchain technology, and so influence its adoption within the banking industry (10).For the acceptance of innovations, the innovation diffusion theory offers a five-stage process: knowledge, persuasion, choice, implementation, and confirmation. When exploring and deploying blockchain technology, banks may go through these stages (10).

Banks, for example, may become aware of blockchain technology and its potential benefits during the knowledge stage. Banks may examine the benefits and drawbacks of adopting blockchain technology during the persuasive stage. Banks may choose to accept or reject blockchain technology during the decision stage. Banks may install blockchain solutions during the implementation stage, and banks may evaluate the results of their adoption efforts during the confirmation step (11).

The relationship between blockchain technology and the innovation diffusion theory entails taking into account the characteristics of the invention, the adoption process, adopter categories, communication channels, and the social structure in which banks operate (6, 12). This research can shed light on how and why blockchain technology might be adopted and spread inside the banking industry

Relative Advantage and Blockchain Adoption in Banks: Relative advantage is a diffusion theory term that describes the perceived superiority of a new innovation over existing alternatives. According to Lin (13), relative advantage refers to the extent to which an innovation is regarded to provide more benefits than its predecessor. Increased productivity, financial gains, and improved status are the effects of relative advantage (14). When it comes to the blockchain system in the banking industry, relative advantage refers to the benefits that blockchain technology can offer to banks compared to traditional banking systems.

Overall, the implementation of blockchain technology in the banking industry has the potential to provide various relative advantages over traditional banking systems, such as increased security, transparency, efficiency, cross-border transactions, and customer experience. It is crucial to remember, however, that blockchain technology is still in its early stages, and its full potential and impact on the banking industry have yet to be realized. Banks need to carefully evaluate the benefits and challenges of implementing blockchain systems and consider various factors such as regulatory compliance, scalability, interoperability, and integration with existing systems before adopting blockchain technology in their operations (15).

H1: Relevant advantage has a positive and significant effect on usage behavior towards

the adoption intention of blockchain technology in private banks.

Complexity and Blockchain Adoption in Banks: Complexity refers to the perceived difficulty or complexity of implementing and integrating blockchain technology into existing banking processes and systems. According to the innovation diffusion theory, the complexity of an innovation can influence the rate and extent of its adoption. Innovations that are perceived as more complex may be adopted at a slower pace or face resistance from potential adopters (14, 15). It is expected that the perceived complexity of implementing and integrating blockchain technology into banking processes and systems may negatively impact the adoption behavior of banks. This is because a higher perception of complexity may create barriers and challenges for private sector banks in India, leading to a lower likelihood of adopting blockchain technology (7).

H2: Complexity has a negative and significant effect on usage behavior towards the adoption intention of blockchain technology in private banks. Compatibility and Blockchain Adoption in Banks

The degree to which a service is viewed as consistent with users’ preexisting values, beliefs, habits, and current and prior experiences is referred to as compatibility (16). Compatibility refers to the degree to which an innovation, such as blockchain technology, can be integrated with existing systems, processes, and infrastructure without disrupting their functionality or requiring significant changes. In the context of the banking industry, the hypothesis suggests that the higher the compatibility of blockchain technology with existing banking systems, the more likely banks are to adopt and implement blockchain in their operations (7).

H3: Compatibility has a positive and significant effect on usage behavior towards

the adoption intention of blockchain technology in private banks.

Observability and Blockchain Adoption in Banks: Observability refers to the degree to which the results or outcomes of an innovation, such as blockchain technology, are visible and easily discernible to potential adopters. According to the innovation diffusion theory, innovations that are more observable are likely to be adopted more quickly as potential adopters can witness the benefits and outcomes of the innovation. Based on this theory, the hypothesis suggests that observability will have a positive effect on the adoption of blockchain in banking. It is expected that the more observable the outcomes of blockchain technology are to potential adopters in the banking industry, the higher the likelihood of adoption. In other words, if private sector banks in India can clearly see the positive results and benefits of implementing blockchain technology, they are more likely to adopt it (8).

H4: Observability has a positive and significant effect on usage behavior towards

the adoption intention of blockchain technology in private banks.

Trialability and Blockchain Adoption in Banks: Trialability, as a concept from diffusion theory, refers to the extent to which an innovation can be experimented with or tested in a controlled setting before full-scale adoption. In the context of the banking industry and blockchain technology, the hypothesis suggests that the higher the level of trialability of blockchain, the more likely banks are to adopt and implement it in their operations. The ability to trial and test blockchain technology in a controlled environment allows banks to adopt a gradual and incremental approach to its implementation. Banks can start with small-scale trials or pilot projects to assess the viability and effectiveness of blockchain in specific use cases or business areas. Based on the results of these trials, banks can gradually expand the adoption of blockchain to other areas, reducing the risks associated with a full-scale implementation (17).

H5: Trialability has a positive and significant effect on usage behavior towards

the adoption intention of blockchain technology in private banks.

RESEARCH METHODOLOGY

Descriptive study was conducted using a survey to gather primary data. At a significance threshold of 0.05, the mean of the responses was statistically validated to be more than, indicating a potentially significant discovery. The respondents were chosen using a purposive sample method, which means that they were picked based on defined criteria or for a specific goal. Due to the lack of an existing scale, a self-structured questionnaire was developed and pretested based on the outcomes of a pilot study to assure its reliability. A total of 400 bank employees were gathered after screening for missing data and partial responses. However, due to the rejection of incomplete or invalid responses, only 250 respondents were chosen for the final analysis towards perception of adoption of blockchain technology in the private bank.

A structural equation model (SEM) was utilised as the statistical test to examine the hypothesis. SEM is a multivariate statistical approach that is often used to analyse correlations between variables and to evaluate complex hypotheses. It is ideal for analysing complex theoretical models since it allows for the examination of both direct and indirect effects. The SEM appears to have been employed to test the study’s hypothesis.

Figure 2: Survey Method

RESULT AND ANALYSIS

Construct reliability, average variance extracted (AVE), and discriminant validity are important concepts in statistical analysis, particularly in the context of structural equation modelling (SEM). These measures are used to assess the quality of the measurement model and the validity of the constructs being studied.

Table 1. Construct reliability, average variance extracted and discriminant validity

| Construct and Factors (Code) | Factor Loads | Construct

Reliability |

Average

Variance Extracted (AVE) |

Discriminant Validity |

| (A) Relative

Advantage (RA)

RA1 RA2 RA3 RA4

|

||||

| 0.777 | 0.468 | 0.777 | ||

| 0.716 | ||||

| 0.805 | ||||

| 0.744 | ||||

| 0.716 | ||||

| (B) Complexity (CPX)

CPX1 CPX2 CPX3 CPX4

|

||||

| 0.835 | 0.6 | 0.835 | ||

| 0.74 | ||||

| 0.744 | ||||

| 0.757 | ||||

| 0.749 | ||||

| (C) Compatibility (COMP)

COMP1 COMP2 COMP3 COMP4 COMP5 COMP6

|

||||

| 0.894 | 0.6 | 0.894 | ||

| 0.713 | ||||

| 0.766 | ||||

| 0.835 | ||||

| 0.782 | ||||

| 0.756 | ||||

| 0.729 | ||||

| (D) Observability (OBS)

OBS1 |

||||

| 0.784 | 0.5 | 0.654 | ||

| OBS2

OBS3

|

0.707 | |||

| 0.782 | ||||

| 0.674 | ||||

| (E) Trialability

TRIA1 TRIA2 TRIA3

|

0.766 | 0.5 | 0.654 | |

| 0.707 | ||||

| 0.782 | ||||

| 0.674 | ||||

| (F) Usage Behavior | ||||

| USG1 | 0.774 | 0.787 | 0.5 | 0.717 |

| USG2 | 0.874 | |||

| USG3 | 0.734 | |||

| USG4 | 0.674 | |||

| (G) Blockchain

adoption intention BAI1 BAI2 BAI3 BAI4 |

0.731 | 0.5 | 0.654 | |

| 0.716 | ||||

| 0.705 | ||||

| 0.844 | ||||

| 0.716 |

Table 2. Hypothesis Testing

| No. | Hypothesis | Std Error | CR | p-value | Path

coff β value |

t-value | Findings |

| H1 | RA→USG | 0.071 | 2.112 | 0.005 | 0.09 | 0.377 | Supported |

| H2 | CPX→USG | 0.034 | 2.664 | 0.005 | -0.056 | -0.086 | Supported |

| H3 | COMP→USG | 0.012 | 2.225 | 0.005 | 0.425 | 3.222 | Supported |

| H4 | OBS→USG | 0.057 | 3.642 | 0.005 | 0.09 | 1.287 | Supported |

| H5 | TRIA→USG | 0.191 | 8.111 | 0.005 | 0.121 | 0.832 | Supported |

| H6 | USG→BAI | 0.191 | 8.052 | 0.005 | 0.121 | 0.812 | Supported |

The results specify that all six hypotheses are supported as there is a substantial relationship amongst analysed variables as presented in Table II. Results indicated that all six alternative hypotheses supported the analysis. For instance, the hypothesized path between RA and USG with a CR value of 2.112 were statistically significant (p=.005), while CPX and USG with a CR value of 2.664 were statistically significant (p=.005). It was found that COMP and USG with a CR value of 2.225 were statistically significant (p=.005), whereas OBS and USG with a CR value of 3.642 were statistically significant (p=.005). Subsequently, TRI and USG with a CR value of 8.111 were statistically significant (p=.005). In addition, USG and BI with a CR value of 8.052 were statistically significant (p=.005) as presented in Table II.

Figure 3: Final SEM Structural Equation Model and Goodness

of Fit Indices of Final SEM Model

The SEM analysis was performed utilizing a sample of 250 respondents in order to assess the relationship among independent variables. The obtained value of χ2 was 28.809 and df= 12 and χ2/df= 2.40075. RMSEA was 0.021 respectively. GFI was 0.923 and AGFI was 0.923 representing that model is a good fit. The incremental fit measures i.e., NFI= .951, RFI= 0.909, IFI= 0.932, TLI=0 .903, CFI=0.912. The value of PRATIO, PNFI and PCFI was 0.672, 0.655 and 0.652.

RESULTS AND DISCUSSION

The findings of this study highlight the importance of various factors in the adoption of blockchain technology in private banks. Relevant advantages, such as enhanced security, transparency, reduced costs, and increased efficiency, are significant drivers that make blockchain technology attractive to private banks. The potential benefits of blockchain technology in terms of improving financial transaction security and efficiency, lowering costs, and increasing transparency correspond with the demands and aims of private banks (1). Furthermore, the perceived complexity of adopting and executing blockchain technology is a significant element that can impact its acceptance. If private banks view blockchain technology to be complex and difficult to incorporate into their existing systems and processes, they may be hesitant to adopt it (2). As a result, efforts to streamline the adoption process and give clear direction and support may help private banks adopt blockchain technology.

The study’s findings emphasize the significance of complexity as a significant obstacle to the adoption of blockchain technology in private banks. The apparent complexity of adopting and using blockchain technology might create hurdles and stymie acceptance in private banks. The observability of blockchain technology’s outputs and advantages is also essential in encouraging its acceptance in private banks. When private banks see the positive consequences of blockchain technology adoption in other organizations or industries, it may boost their confidence in its efficacy and urge them to adopt it (1). To address the perceived complexity of deploying blockchain technology in private banks, efforts to streamline the adoption process and provide clear guidance and support may be required.

This could involve conducting training and education programs, providing technical assistance, and building regulatory frameworks that provide clarity and ease compliance. Furthermore, trialability, which allows private banks to experiment with and test blockchain technology on a modest scale, can allow them to assess its effectiveness and suitability before fully adopting it (3). This can help reduce the risks and uncertainties associated with adopting new technologies, encouraging private banks to use blockchain technology.

Key stakeholders need to be made aware of the relative benefits of blockchain technology, such as operational effectiveness, transparency, and security, by banks. By emphasising these advantages, banks in the private sector may have a more favourable impression of them and be more likely to embrace them. Banks should give key stakeholders the chance to see the advantages and results of blockchain technology. This can be accomplished through proof-of-concepts, case studies, or pilot projects that demonstrate effective implementation and beneficial outcomes. Increased observability can encourage adoption by boosting confidence.

Recommendations: Conduct comparison study using the innovation diffusion theory to compare the adoption patterns of private sector banks in India with those in other countries or regions. This can provide light on the particular factors that affect blockchain implementation in the Indian banking sector and reveal similarities and differences in adoption patterns, drivers, and barriers in various situations.

Conduct an exploratory study to look at new trends, challenges, and opportunities related to blockchain adoption in the banking industry. This study will combine innovation diffusion theory, AI, and expert perspectives. This can indicate fresh study directions and areas for additional investigation in addition to providing a glimpse into the use of blockchain in India’s private sector banks in the future.

In general, more research on the application of innovation diffusion theory to the usage patterns of blockchain adoption by private sector banks in India can help us better understand the factors that influence, hinder, and have an impact on the adoption of blockchain in the banking industry. Additionally, it can provide policymakers, practitioners, and researchers with useful insights into creating policies and initiatives that would increase the adoption of blockchain technology in India’s private sector banks.

CONCLUSION

Innovation diffusion theory in conjunction to understand the perception of usage behaviour of blockchain adoption by private sector banks in India can provide valuable insights that can drive decision-making, innovation management, and policy creation. These consequences may lead to the faster adoption of blockchain technology in the financial sector and the realisation of its potential benefits for India’s private sector banks. Finally, the study discovered that relevant advantages, complexity, compatibility, observability, and trialability all have a favourable and significant impact on usage behaviour towards blockchain technology adoption in private banks. The study also concludes and suggests that complexity is a significant impediment to blockchain technology adoption in private banks. Addressing the perceived difficulty of adopting and using blockchain technology may be critical for promoting its acceptance and realising its potential benefits in the private banking business.

Conflict of Interest: Author declares no conflict of interest.

REFERENCES

- Al-Ashmori A, Basri SB, Dominic PDD, Capretz LF, Muneer A, Balogun AO, et al. Classifications of Sustainable Factors in Blockchain Adoption: A Literature Review and Bibliometric Analysis. Sustainability. 2022;14(9):5176.

- Al-Jabri IM, Sohail MS. Mobile banking adoption: Application of diffusion of innovation theory. J Electron Commerce Res. 2012;13(4):379-91.

- Jain P, Agarwal G. Factors affecting mobile banking adoption: an empirical study in Gwalior region. Int J Digit Account Res. 2019;19(4):79-101.

- Kawasmi Z, Gyasi EA, Dadd D. Blockchain adoption model for the global banking industry. J Int Technol Inf Manag. 2020;28(4):112-54.

- Khalil M, Khawaja KF, Sarfraz M. The adoption of blockchain technology in the financial sector during the era of fourth industrial revolution: a moderated mediated model. Qual Quant. 2021;1-

- Khatri A, Kaushik A. Systematic Literature Review on Blockchain Adoption in Banking. J Econ Financ Account. 2021;8(3):126-46.

- Lou AT, Li EY. Integrating innovation diffusion theory and the technology acceptance model: The adoption of blockchain technology from business managers’ perspective.

- Mang’ana R. Strategic Adoption of Technological Innovations on Competitive Advantage of Commercial Banks in Kenya. J Bus Strateg Manag. 2022;7(2):16-36.

- Martino P. Blockchain technology: challenges and opportunities for banks. Int J Financ Innov Bank. 2019;2(4):314-33.

- Nor KM, Pearson JM, Ahmad A. Adoption of internet banking: theory of the diffusion of innovation. Int J Manag Stud. 2010;17(1):69-85.

- Polas MRH, Jahanshahi AA, Kabir AI, Sohel-Uz-Zaman ASM, Osman AR, Karim R. Artificial Intelligence, Blockchain Technology, and Risk-Taking Behavior in the 4.0 IR Metaverse Era: Evidence from Bangladesh-Based SMEs. J Open Innov Technol Mark Complex. 2022;8(3):168.

- Rahayu R, Mariska W, Garantjang MF. E-Payment Innovation in Improving Bank Indonesia’s Financial Performance. Int J Econ Bus Account Res. 2022;6(1):381-6.

- Saheb T, Mamaghani FH. Exploring the barriers and organizational values of blockchain adoption in the banking industry. J High Technol Manag Res. 2021;32(2):100417.

- Schuetz S, Venkatesh V. Blockchain, adoption, and financial inclusion in India: Research opportunities. Int J Inf Manag. 2020;52:101936.

- Taherdoost H. A critical review of blockchain acceptance models—blockchain technology adoption frameworks and applications. Comput. 2022;11(2):24.

- Ullah N, Al-Rahmi WM, Alfarraj O, Alalwan N, Alzahrani AI, Ramayah T, et al. Hybridizing cost saving with trust for blockchain technology adoption by financial institutions. Telemat Inform Rep. 2022;6:100008.

- Wang YS, Wu SC, Lin HH, Wang YM, He TR. Determinants of user adoption of web”Automatic Teller Machines’: an integrated model of’Transaction Cost Theory’and’Innovation Diffusion Theory’. Serv Ind J. 2012;32(9):1505-25.