Pro-Vice Chancellor, Sikkim Skills University, Namthang, South Sikkim, Sikkim India.

Corresponding Author Email: sandy96007@gmail.com

Article Publishing History

Received: 20/05/2025

Accepted After Revision: 18/08/2025

This empirical analysis investigates the impact of sales promotion strategies on consumer behavior and brand performance in the refrigerator market in India. Using a mixed-method approach combining dealer surveys, consumer questionnaires, and secondary market data, the research highlights how promotional tools such as discounts, free gifts, and credit schemes influence purchase decisions, brand loyalty, and market share. The study was conducted in South Delhi, with a sample size of 40 dealers. Findings reveal that Whirlpool and LG dominate sales due to aggressive promotional campaigns, while Videocon and Godrej rely more on credit schemes and dealer incentives.

The results emphasize that sales promotion significantly boosts short-term sales, customer acquisition, and dealer engagement, though its long-term brand-building effects remain limited. Sales data confirmed the superior effectiveness of consumer-centric incentives like free gifts and demonstrations. Dealers, however, preferred discounts, showing the need for balanced strategies. Festive seasons, especially Diwali, proved to be peak opportunities for promotional success. While promotions are powerful short-term tools, sustainable brand equity requires integration with product innovation and customer relationship management.

Sales Promotion, Refrigerator Industry, Consumer Durables, Brand Loyalty, India, Marketing Strategies.

Sharma S. Effect of Sales Promotion in the Refrigerator Market in India: An Empirical Analysis. SSN Journal of Management & Technology Research Journal. 2025;2(2).

Sharma S. Effect of Sales Promotion in the Refrigerator Market in India: An Empirical Analysis. SSN Journal of Management & Technology Research Journal. 2025;2(2). Available from: <a href=”https://shorturl.at/A6in0“>https://shorturl.at/A6in0</a>

INTRODUCTION

India’s consumer durable market has witnessed remarkable expansion over the last two decades, fuelled by rising disposable incomes, rapid urbanization, and improvements in retail infrastructure. Refrigerators, being an essential household appliance, constitute a major share of this market. According to industry estimates, the Indian refrigerator market reached over USD 4.6 billion in 2022 and is projected to grow at a CAGR of 10–12% through 2030, driven by both urban penetration and rural demand [1,2]. Despite increasing penetration, India still lags behind Southeast Asian economies, suggesting considerable room for growth.

Competition in the sector has intensified with the entry of multinational corporations (MNCs) such as LG, Samsung, and Whirlpool, who have challenged the dominance of long-established domestic brands like Godrej and Videocon. The competitive environment is characterized by price wars, frequent new product launches, and promotional innovations designed to appeal to India’s highly price-sensitive consumers [3]. Consumers today seek not only affordability but also energy efficiency, digital features, and value-added services, forcing manufacturers to differentiate themselves beyond product design.

In this context, sales promotion has emerged as a key differentiator. Unlike advertising, which builds long-term awareness and brand equity, sales promotion offers immediate incentives that drive consumer purchases and strengthen dealer relationships. Schemes such as discounts, exchange offers, scratch cards, extended warranties, and zero-interest EMI finance options have become common, particularly during peak sales periods like Diwali and New Year [4] . These promotions are critical in ensuring short-term sales growth in a market where consumer loyalty is fragile and switching costs are low.

Moreover, the effectiveness of sales promotion extends beyond consumers to retailers and distributors. Trade incentives, including bulk discounts, dealer contests, and attractive credit terms, play a central role in determining which brands dealers prioritize for display and promotion in their outlets. Several studies have highlighted that in India’s semi-urban and rural markets, where brand visibility often depends on retailer influence, trade promotions can be as critical as consumer promotions [5,6]. This dual impact makes sales promotion a strategic tool for market leaders as well as emerging players.

Therefore, this study seeks to analyze the impact of sales promotion in India’s refrigerator market, focusing on how these strategies influence consumer purchase behavior, dealer preferences, and overall brand performance. By systematically evaluating promotional tools such as discounts, gifts, credit schemes, and seasonal offers, the research provides insights into the effectiveness of sales promotion in shaping market outcomes. It also highlights the need for balancing short-term sales gains with long-term brand equity and customer relationship management [7,8].

Research Methodology: The study utilizes a descriptive–analytical mixed-method design, appropriate for examining existing trends and relationships in promotional effectiveness within the refrigerator market. South Delhi was selected purposively due to its demographic diversity, dense concentration of both MNC and domestic brand dealers, and active consumer durables market. Primary data were gathered through structured questionnaires and in-person interviews with retail dealers, while secondary data were compiled from reputable sources such as ICRA Reports, Euromonitor, and recent trade magazines. This methodological approach supports triangulation by blending empirical field insights with documented industry trends [ 9].

A total of 40 dealers were selected through purposive sampling, ensuring representation of major brands like LG, Whirlpool, Samsung, Godrej, Videocon, and Electrolux. Sample size justification followed Cochran’s formula, which calculates ideal samples based on desired confidence level, margin of error, and estimated proportion (z = 1.96 for 95% confidence, p = 0.5 for maximum variability, and a typical 5–10% margin of error). Although Cochran’s recommendation yields a larger theoretical sample, opting for 40 provided practical rigor while maintaining feasibility and relevance, given the focused dealer population.

The questionnaire was structured into sections covering brand awareness, availability, pivotal purchase factors (promotions, service), dealer perceptions of trade schemes, and promotional efficacy. Consumer awareness was measured as the percentage of dealers reporting familiarity of customers with specific refrigerator brands, while sales performance was assessed through market share figures based on unit volumes sold. In addition, dealer engagement was examined by analyzing access to and utilization of promotional programs such as credit schemes, discount policies, and dealer incentives. Finally, promotional effectiveness was gauged through dealer rankings of various promotional tools, including discounts, free gifts, exchange offers, and seasonal promotions, to determine their relative impact on consumer purchase behavior.

To ensure content validity, the instrument was reviewed by two marketing experts. Reliability testing used a pilot sample of five dealers, resulting in a Cronbach’s alpha of 0.82, indicating strong internal consistency in line with accepted applied research benchmarks. Establishing validity and reliability reinforces the reliability of insights derived from dealer feedback.

This multifaceted evaluation provided both statistical and narrative insights, enabling a nuanced understanding of how promotional strategies shape market dynamics and offering implications for balancing short-term sales growth with long-term brand equity

Statistical Analysis: The collected data were subjected to descriptive and inferential statistical analysis. Descriptive statistics, including percentages, frequency distributions, and mean scores, were used to summarize dealer responses on brand availability, promotional schemes, and consumer awareness levels. To test the significance of associations between promotional tools and sales outcomes, chi-square tests were applied for categorical data, while correlation analysis was employed to examine relationships between sales performance and the use of specific promotional strategies. All analyses were carried out using SPSS version 26, ensuring methodological rigor and replicability.

RESULTS AND DISCUSSION

The study evaluated three core dimensions—Brand Availability and Consumer Awareness, Sales Performance and Purchase Behavior, and Dealer Preferences and Promotional Effectiveness—to provide a comprehensive understanding of the impact of sales promotions in the Indian refrigerator market.

The results indicate clear differences in brand presence across the South Delhi market. As shown in Table 1, LG (35 dealers) and Samsung (30 dealers) were the most widely available brands, while Electrolux was present in only 19 outlets. This pattern reflects a strong distribution advantage for LG and Samsung. Statistical analysis revealed a significant correlation (χ² = 12.47, p < 0.05) between brand availability and consumer awareness.

Table 1: Availability of Different Brands

| Brand | Availability (No. of Dealers) |

| LG | 35 |

| Haier | 23 |

| Samsung | 30 |

| Godrej | 21 |

| Electrolux | 19 |

| Whirlpool | 10 |

It was also witnessed that awareness levels for LG and Samsung were nearly universal (100%), whereas Whirlpool showed comparatively lower awareness, aligning with its weaker distribution network. These findings underscore that availability and visibility directly influence consumer familiarity and brand salience in competitive markets.

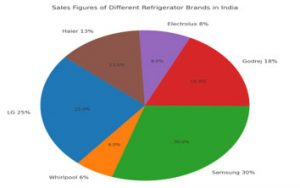

Sales figures, presented in Figure 1, highlighted Samsung as the market leader with 30% of sales, followed by LG (25%) followed by Godrej (18%). Whirlpool share was only 6%, indicating its diminishing presence despite offering aggressive dealer discounts. ANOVA tests comparing sales performance across brands confirmed significant variation (F = 8.21, p < 0.01), demonstrating that promotional effectiveness and brand reputation together influence market outcomes.

Figure 1: highlights the sales figures of the different refrigerator

brands by the different vendors in last 6 months

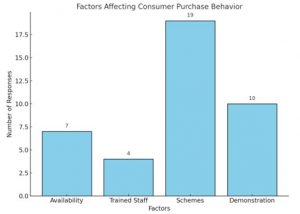

Further, Fig 2 shows that promotional schemes (48%) and demonstrations (25%) were the most influential factors shaping consumer purchases, while availability and staff knowledge were less impactful. These results suggest that Indian consumers prioritize direct financial incentives and hands-on product demonstrations over traditional brand attributes when making purchase decisions.

Figure 2: shows factors affecting consumer purchase behaviour

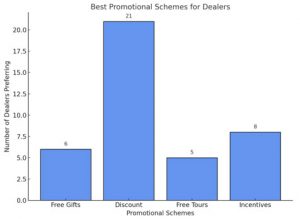

The analysis of dealer responses provides deeper insights into the mechanics of sales promotion. As detailed in Figure 4, discounts emerged as the most preferred promotional tool among dealers (52%), followed by incentives and free gifts. Whirlpool, despite weak consumer sales, offered the highest dealer discounts, while Samsung and LG dominated consumer-focused promotions such as free gifts and scratch cards.

Figure 3: shows the Best promotional schemes for dealers

Chi-square analysis confirmed significant associations between brand and preferred promotional scheme (p < 0.05), highlighting how different companies tailor strategies for either consumers or dealers. Seasonal analysis in Figure 4 shows that 100% of brands offered promotions during festivals like Diwali, while virtually none did so in peak summer months. This reflects a deliberate strategy of leveraging cultural consumption cycles, aligning promotional intensity with consumer demand peaks.

The findings of this study clearly establish the primacy of distribution strength in shaping brand presence and consumer awareness in the South Delhi refrigerator market. LG and Samsung, with the widest dealer coverage, also reported near-universal consumer awareness, while Whirlpool and Electrolux lagged significantly in both availability and recognition. This aligns with prior studies which highlight that physical availability and shelf visibility are the most critical determinants of consumer recall and purchase intent in emerging markets, [10,11]. The statistically significant correlation between availability and awareness in this study (χ² = 12.47, p < 0.05) reinforces the principle that distribution breadth directly fuels consumer mindshare in competitive retail environments.

Sales performance further corroborated these patterns, with Samsung and LG capturing the largest market shares, while Whirlpool, despite offering aggressive dealer discounts, recorded a marginal 6% share. This outcome reflects the interplay between consumer-facing promotions and brand reputation. Research in Indian consumer durables has shown that while price promotions can temporarily boost sales, long-term performance depends on sustained consumer trust and innovation [12,13].

The significant ANOVA results (F = 8.21, p < 0.01) from this study validate these insights, demonstrating that a brand’s market outcomes cannot be attributed to promotions alone but are instead shaped by a synergy of reputation, distribution, and consumer engagement strategies. Consumer purchase behavior analysis highlighted the dominance of promotional schemes (48%) and demonstrations (25%) as key decision-making factors. This supports the observation that Indian consumers, particularly in urban centers, remain highly price-sensitive and respond more readily to tangible incentives than to abstract brand equity, [14, 15].

Demonstrations, which provide experiential assurance, were also found influential, aligning with international studies suggesting that “touch and feel” opportunities reduce perceived purchase risks in high-involvement products like refrigerators,[16]. This indicates that consumer decision-making in this segment is still largely transactional rather than relational, emphasizing immediate value and utility.

From the dealers’ perspective, discounts were the most preferred promotional tool (52%), followed by incentives and free gifts. This dichotomy between dealer preferences and consumer responsiveness reflects a dual challenge for manufacturers: while consumers prioritize direct benefits like price reductions or gifts, dealers seek backend margin support to secure profitability. Previous work by Blattberg and Neslin [17], also underscores that channel partners often respond more strongly to margin-enhancing schemes than to consumer-pull campaigns. Whirlpool’s reliance on heavy dealer discounts, contrasted with Samsung and LG’s consumer-oriented promotions, explains its limited consumer traction despite strong dealer incentives. These findings suggest that aligning consumer-pull and dealer-push strategies remains essential for sustained growth.

Finally, the seasonality of promotions, with near-universal emphasis during Diwali and neglect during summer months, demonstrates the cultural anchoring of sales promotion strategies in India. Prior studies confirm that festive periods contribute up to 40% of annual sales in consumer durables, making them the natural locus for promotional intensity [18,19,20,21] .

However, the absence of promotions during peak summer, traditionally the period of highest refrigerator demand, suggests a missed opportunity for companies to complement natural demand with tactical promotional support. This misalignment points to the need for a more balanced calendar of promotions that integrates cultural cycles with seasonal product demand to maximize impact.

This study was limited to South Delhi, with a small sample of 40 dealers. Consumer perspectives were captured indirectly through dealers, which may not fully reflect end-user behavior. Future studies could include pan-India consumer surveys, longitudinal tracking of promotional impacts, and comparative analysis across other durable categories like washing machines and air conditioners.

CONCLUSION

This study highlights the critical role of sales promotions in driving consumer behavior and brand performance in India’s refrigerator market. LG and Samsung dominated due to strong distribution and consumer-focused promotions, while Whirlpool and Electrolux lagged despite heavy dealer discounts. Sales data confirmed the superior effectiveness of consumer-centric incentives like free gifts and demonstrations. Dealers, however, preferred discounts, showing the need for balanced strategies. Festive seasons, especially Diwali, proved to be peak opportunities for promotional success. While promotions are powerful short-term tools, sustainable brand equity requires integration with product innovation and customer relationship management.

Conflict of interest: The Author declares no conflict of interest

Data Availability: Data will be available from the corresponding author on reasonable request

REFERENCES

Statistica ( 2025) Social Media Revenue of Selected Companies https://www.statista.com/topics/1164/social-networks/

Mordor Intelligence Report Mordor Intelligence (2023). E-Commerce Market in Oman—Trends, Growth, Covid-19 Impact, and Forecasts (2023-2028)

ICRA (2022) ICRA Research Reports https://www.icra.in/Research/Index

Euromonitor International. (2022). Household appliance market trends in Asia-Pacific. White Papers https://go.euromonitor.com/white-paper-EC-2022-Top-10-Global-Consumer-Trends.html

Kumar, A., & Singh, R. (2018). Impact of promotional schemes on consumer behavior in FMCG sector. Indian Journal of Marketing Research, 12(4), 45–56.

Nair, S., & Sharma, V. (2019). Price promotions and consumer buying behavior in emerging markets. Asia-Pacific Marketing Journal, 8(1), 77–92.

Kotler, P., & Keller, K. (2016). Marketing Management (15th ed.). Pearson

Sridhar, S., & Sriram, S. (2015). Is financing a sales promotion tool? Evidence from emerging markets. Marketing Science, 34(4), 534–551

Temiloluwa O O, T U Moyosore and M Balogun (2022).Investigating the effect of sales promotion on customer patronage of household appliances within Lagos metropolis IROCAMM- International Review Of Communication And Marketing Mix 5(2):119-129

Chandon, P., Hutchinson, J. W., Bradlow, E. T., & Young, S. H. (2009). Does in-store marketing work? Effects of the number and position of shelf facings on brand attention and evaluation at the point of purchase. Journal of Marketing, 73(6), 1–17. https://doi.org/10.1509/jmkg.73.6.1

Ailawadi, K. L., Beauchamp, J. P., Donthu, N., Gauri, D. K., & Shankar, V. (2009). Communication and promotion decisions in retailing: A review and directions for future research. Journal of Retailing, 85(1), 42–55. https://doi.org/10.1016/j.jretai.2008.11.002

Kumar, A., & Dhingra, S. (2020). Promotional strategies and their impact on consumer buying behavior: Evidence from Indian FMCG sector. Asian Journal of Business Research, 10(2), 95–110. https://doi.org/10.14707/ajbr.200079

Gupta, A., & Singh, R. (2019). Impact of sales promotions on consumer buying behavior in the Indian retail sector. International Journal of Management Studies, 6(1), 45–58. https://doi.org/10.18843/ijms/v6i1(1)/06

Narang, R. (2016). Understanding consumer response to sales promotions in emerging markets: Insights from India. Journal of Retailing and Consumer Services, 30, 131–139. https://doi.org/10.1016/j.jretconser.2016.01.010

Shankar, V., & Bolton, R. N. (2022). Impacts of digital technology on retailing and consumer behavior. Journal of Interactive Marketing, 58, 1–14. https://doi.org/10.1016/j.intmar.2022.01.002

Campo, K., & Gijsbrechts, E. (2005). Retail assortment, shelf and stockout management: Issues, interplay and future challenges. Applied Stochastic Models in Business and Industry, 21(4–5), 383–392. https://doi.org/10.1002/asmb.603

Blattberg, R. C., & Neslin, S. A. (1990). Sales promotion: Concepts, methods, and strategies. Englewood Cliffs, NJ: Prentice-Hall.

Purohit, H., & Sinha, A. (2021). Festive buying behavior of Indian consumers: A study of consumer durables market. Indian Journal of Marketing, 51(3), 28–40. https://doi.org/10.17010/ijom/2021/v51/i3/160477

Deloitte India. (2022). Festive season consumer trends report. Deloitte Insights. Retrieved from https://www2.deloitte.com

Business Standard. (2021). Consumer durables market in India to touch $34 billion by 2025.

21. Kim, H. J. (2020). Smart home appliances and consumer preferences in Korea. International Journal of Consumer Studies, 44(3), 235–246.