1Assistant Professor, Faculty of Management and Commerce, ICFAI University Tripura, India.

2Ph.D. Research Scholar, Department of Management, Mizoram University, Aizwal, Mizoram, India.

3Assistant Professor, Faculty of Management and Commerce, ICFAI University Tripura, India.

*Corresponding Author email- dipangshuchowdhury@gmail.com

Article Publishing History

Received: 15/07/2026

Accepted After Revision: 24/09/2025

Digital trade has revolutionized international trade by making cross-border transactions almost instantaneous through the use of e-commerce, cloud computing and digital payments. However, this fast-paced digital evolution revealed major gaps in policy and law. Issues such as taxation, consumer protection and regulatory convergence are being negotiated. Tax systems developed decades ago are based on the concept ofphysical presence, so digital services are under-taxed; and consumer protection laws, which are territorial in nature, are not sufficient to protect consumers who purchase from sellers across borders.

From a doctrinal and comparative legal analysis this contribution investigates these questions in light of the (multilateral) processes under the OECD and WTO and domestic law/regional agreements (e.g. the EU DSA, India’s Equalization Levy, CPTPP and RCEP).It reviews the extent to which tax systems can raise revenues from digital activity, the difficulties associated with online consumer protection, and the extent of global harmonization.

The findings reveal that there is an un-fragmented governance and it is generally weak in linking tax and consumer policies particularly for the developing countries. The study proposes that regulation of digital trade should be fair and this can be accomplished through agency cooperation, capacity development, ethical responsibility, and enhanced multilateral collaboration that will advance equity, growth, and consumer good in the era of digital trade.

Digital Trade, Taxation, Consumer Protection, Global Governance.

Das B, Dey T. K, Chowdhury D.D. Can Global Legal Frameworks Harmonise Taxation and Consumer Protection in Cross-Border Digital Trade. SSN Journal of Management & Technology Research Journal. 2025;2(2).

Das B, Dey T.K, Chowdhury D.D. Can Global Legal Frameworks Harmonise Taxation and Consumer Protection in Cross-Border Digital Trade. SSN Journal of Management & Technology Research Journal. 2025;2(2). Available from: <a href=”https://shorturl.at/Eg2G4“>https://shorturl.at/Eg2G4</a>

INTRODUCTION

Digital trade is the principal driver of the global reorganization of economic relations among countries, firms, and consumers. In fact, small and medium enterprises (SMEs) are able to go global with ease through the said platforms like Amazon, Alibaba, etc, without the need for them to establish physical infrastructure in foreign lands. Meanwhile, cloud computing, digital payment systems, and real-time data analytics are the technologies that allow firms to open their offices in different jurisdictions at the same time.

Cross-border digital services increased at the rate of about 25 per cent every year during the last five years, the OECD study shows[1], implying that both the scale and the speed of digital trade expansion are enormous. Behind the unprecedented expansion in digital trade is a complex set of regulatory issues. Consumer protection laws and traditional tax systems, let alone international trade agreements, were built around physical goods that move through intermediaries, require physical presence and are subject to territorial jurisdiction. At the same time, digital goods and services are intangible and, in many cases, disaggregated, taking their source from the same source.

The combination of these factors wreaks havoc with governments that want to tax, consumers that want to complain, and firms that want to comply. Consumers are the most at-risk segment of society. Cross-border transactions may expose consumers to various risks including dealing with counterfeit sellers, misrepresented products, delivery delay and even misuse of personal information. The enforcement of consumer rights is however, not under one roof but is fragmented among the national authorities with very limited powers extraterritorially. The asymmetry creates not only gaps in protection and trust, but also suggests that these digital marketplaces may be less credible than their regular counterparts.

Besides that, digital trade raises questions about fairness. Rich countries and big corporations have the upper hand over poor countries as they do not lack the technological and financial resources to take advantage of the loopholes, while the latter cannot do much but suffer from the loss of tax and from their consumers being at the risk of the lack of protection. Digital trade, without law and policy interventions, has the potential of deepening the existing global inequalities that predominantly benefit multinational platforms while harming small players and consumers in less developed regions.

This paper addresses the issues of taxation, consumer protection, and global harmonization, i.e., three interrelated areas of digital trade governance. The areas examined by this work show the countries and international organizations the way to a digitally inclusive, transparent, and efficient economy that manages to strike a balance between innovation, revenue generation, and consumer welfare.

Research Problem and Significance : Problem Statement One of the main challenges for existing legal frameworks that are designed to regulate digital trade is their limitation. Ancient tax systems founded on the concept of a “permanent establishment” could not tax companies operating without a physical footprint. In practice, this has allowed global tech platforms such as Google, Facebook and Amazon to generate huge profits in a range of countries without paying significant tax in those countries, creating fiscal disparities.

Furthermore, consumer protection regimes are in large part national and reliant on national enforcement models. Where consumers have disputes with sellers in cross-border sales, redress is difficult to secure for consumers and enforcement across borders is patchy. Conflicting rules on taxation, data privacy and consumer protection between countries impose compliance costs on businesses, reduce the predictability of trade and may discourage small and medium-sized enterprises from participating in cross-border trade.

Significance of the Study: However, traditional tax systems based on the concept of ‘permanent establishment’ are not suitable for taxing enterprises operating without a physical presence. Essentially, multinational platforms like Google, Face Book and Amazon can earn huge profits in many different countries, but pay taxes almost entirely in their home jurisdictions, creating fiscal inequities. Furthermore, consumer protection regimes tend to be national and rely on enforcement at the national level.

Consumers cannot obtain remedies easily for their disputes with sellers over cross-border transactions and at the same time, international enforcement of such remedies is unstable when they have disputes with sellers over cross-border transactions. Differing tax, data privacy, and consumer protection rules that exist across countries create compliance challenges for businesses, reduce the predictability of trade, and may be a disincentive for SMEs to participate in cross-border trade.

Research Questions

This research paper poses the following questions:

- In what manner do the current tax systems consider the income generated by digital cross-border platforms?

- What are the foremost limitations of consumer protection through the enforcement of law in cross-border e-commerce?

- How far do the OECD and WTO frameworks lead to the harmonisation of digital trade governance?

- Which institutional reforms would be instrumental in creating a digitally inclusive market?

Research Objectives

- To identify major issues in the imposition of taxes on cross-border digital transactions and services that influence fiscal equity and market fairness.

- To measure the performance of current laws protecting consumers in the context of global e-commerce.

- Analysis of the function of the international organisations (OECD, WTO, UNCTAD) in standardising the policies related to digital taxation and consumer rights.

- To suggest global strategies that facilitate regulatory consistency, financial fairness, and the fair expansion of the digital trade.

Literature Review

Taxation of Digital Commerce: The issue of taxation has been at the centre of challenges in the digital trade governance area. Existing tax systems are designed in such a way that they are closely linked to the physical presence of a business. However, digital companies are operating in a virtual environment and in most cases, they do not have offices, employees, or even stock in the countries from which they have users. In an attempt to overcome the difficulties, the OECD’s BEPS framework leads to in the first place (reallocation of profits to market jurisdictions) and, secondly minimum global tax[6,7] that address such issues.

However, the rollout of these ideas is not consistent and some critics are convinced that these initiatives are more geared towards benefiting wealthy countries. Thus by themselves, India’s Equalisation Levy and EU’s digital-services tax as examples look like good solutions to the problem of domestic revenue losing but they do carry a risk of trade disputes.

Consumer Protection: While consumers are engaged in cross-border transactions, they may be exposed to multiple kinds of risks such as fraud, non-delivery, and personal data misuse. OECD & UN consumer protection Guidelines[2] set up the rules of the game by suggesting cross-border cooperation, transparency, and accountability; however, these rules are hardly ever enforced. The European Union Digital Services Act (2022) is a well-organized full-spectrum coding of platform liability[4], content moderation, and grievance redress.

India’s Consumer Protection (E-commerce) Rules (2020) are intended to regulate e-commerce marketplaces[5] but are weak on cross-border enforcement. Dispute resolution online platforms, for instance, the EU ODR system, are potentially a part of the answer; however, they are dependent on global reciprocity to function fully.

Harmonization Efforts: Both multilateral and regional frameworks are designed to facilitate the harmonization of digital trade regulations among members. WTO’s Joint Statement Initiative intends to set global standards[8] but the engagement in it is still voluntary. The OECD promotes interoperability, which enables countries to adjust regulations to their domestic needs and at the same time keep them compatible across borders.

The regional agreements, such as CPTPP[10], RCEP[11], and USMCA[12] have incorporated digital trade chapters that deal with the topics such as data flow, consumer protection, and cybersecurity. Nevertheless, the extent of the commitments causes variability, leading to the so-called “fragmented multilateralism.” Successful harmonization depends on how well national regulations are in line with the international standards and at the same time allow policy space for the developing countries.

Research Gaps: Despite an increasing number of studies, there are still large gaps: a) Integration of Taxation and Consumer Protection: Most of the studies focus on fiscal or consumer issues separately; only a handful of research works consider their intersection and consequences for the digital-trade policy.

- Empirical Evaluation in Less Advanced Countries The Influence of Digital Trade on Taxation, Market Access, and Consumer Welfare in developing countries remains to be fully examined.

- Consumer Redress: There is little research on the efficacy of cross-border ODR schemes.

- Comparative analysis of harmonization efforts: The regional and plurilateral processes, are fragmented, a holistic consideration that brings out their cumulative shaping of a balanced (for developing countries) regime of digital-trade governance is absent.

DISCUSSION

Taxation Challenges: Trade in the digital era challenges fixed establishment ideas. In the digital business, significant income is earned without having a physical presence in the jurisdiction, leading to an erosion of the tax base. Developing countries are pushing for consumption taxation because the profits are earned from consumers that are active in their markets.OECD’s BEPS Pillars are a guiding light, yet implementation is diverse[6,7]. On the one hand, unilateral digital taxation may contribute to close revenue gaps and, on the other, to trade retaliation. It would be very difficult for people to do real-time monitoring and at the same time keep the situation very transparent, if it were not for technological developments such as blockchain and AI. These can enable transparent taxation while coexisting in harmony with the minimal compliance cost requirement.

Figure 1

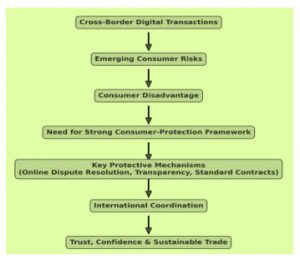

Consumer-Protection Imperatives: Consumers are the most disadvantaged in cross-border digital transactions. Among the threats are fraudulent platforms, misrepresentation, and algorithmic exploitation. A strong consumer-protection system is the best weapon to regain lost trust and at the same time it acts as an incentive[17,18]. Participants would be happy if for instance, they find an online method of conflict resolution, mechanisms of transparency, and standard contracts, all being in place. They would also feel secure since these activities are coordinated at an international level by the relevant authorities of the involved countries and, thus, enforcement and dispute resolution are efficient worldwide.

Figure 2

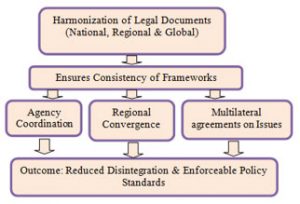

Harmonisation and Policy Coherence: By harmonising different legal documents, it is ensured that national, regional, and global frameworks are consistent with each other. Along with that, the coordination between the different agencies, the convergence on the different regions, and the agreement on the issues discussed in the multilateral fora are very important factors to be considered. Therefore, among others, these three examples – ASEAN Digital Economy Framework[13], African Union Digital Strategy[14], and EU Digital Single Market[15], – show how cooperation among respective partners can lessen disintegration. Even so, harmonization must continue to rely on policy constraints and standards that can be enforced.

Figure 3

Inclusivity and Development Perspectives: Developing countries have to grapple with various problems arising from the lack of proper digital trade infrastructures and the insufficient capacity of the people to understand and manage the sector at the same time. The main constituents of inclusive policies are involvement in decision-making, technical help, and raising of the capacity level through training and workshops. One such program is UNCTAD eTrade for All, which opens up legal frameworks for all by linking them with infrastructure and skills development.

Figure 4

Ethical and Socioeconomic Dimensions: Essentially, the subject of ethics is beyond the scope of technical regulation. Tax avoidance, weak consumer protection, and data misuse are just a few of the ways that fairness is being undermined. The idea of ethical leadership encompasses these values, to name a few, as well as some of the ones above: transparency, accountability and corporate social responsibility. The inclusion of ethics will lead to improved public trust, sharing of economic benefits, and sustainable digital development.

CONCLUSION

It is evident that digital trade is transforming economic activity around the world but regulatory frameworks are still organised to support physical trade. As it is seen in the analysis, taxation, consumer protection and regulatory harmonization are the core of the governance issues that arise in the digital age. The old tax regulations, along geographical lines, are not able to reflect the digital generation of value, as this leaves major gaps in revenues, particularly in emerging economies. Likewise, the incoherent consumer-protection regimes do not provide accountability across borders, putting the consumers at risk of fraud, misuse of data and uneven systems of redress. Although the international measures, the BEPS reforms of OECD, the Joint Statement Initiative of WTO, the regional treaties, like CPTPP, RCEP, and the USMCA are imperative steps towards the achievement of coherence, they are still fragmented, voluntary, or partial.

Asymmetries in digital capacity, institutional readiness and bargaining power still persist in developing countries, and this demonstrates the necessity of inclusive, capability-strengthening forms of governance. An evolutionary digital trade regime needs to incorporate, therefore, equitable taxation, enforceable consumer rights, interoperable regulatory systems and specificity in capacity building. Combined with these factors, digital trade may become an engine of justifiable development, accountability, and trust. To realise this vision, a global collaboration that is based on fairness, technological flexibility, and collective responsibility will be needed.

Conflict of Interest: None of the authors of this research work has any conflict of interest that may affect the publication of this research work.

Data Availability: All data are available with the corresponding author on reasonable request

REFERENCES

- Digital Trade in the OECD Area 2023. https://www.oecd.org/trade/digital-trade/

- OECD Consumer Protection in E-commerce (2016). https://www.oecd.org/sti/consumer/e-commerce.htm

- United Nations. UN Guidelines for Consumer Protection (2016). https://unctad.org/system/files/official-document/ditccplpmisc2016d1_en.pdf

- European Union. Digital Services Act (2022). https://digital-strategy.ec.europa.eu/en/policies/digital-services-act-package

- Government of India. Consumer Protection (E-commerce) Rules (2020). https://consumeraffairs.nic.in/acts-and-rules/consumer-protection-e-commerce-rules-2020

- BEPS Action 1: Digital Economy (2020). DOI: 10.1787/0e8f0fc7-en

- Two-Pillar Solution for Digital Taxation (2021). https://www.oecd.org/tax/beps/two-pillar-solution/

- Joint Statement Initiative on E-commerce. https://www.wto.org/english/tratop_e/ecom_e/joint_statement_e.htm

- eTrade for All (2023). https://etradeforall.org/

- CPTPP Agreement Text. Government of Canada. https://www.international.gc.ca/…/cptpp-ptpgp/text-texte/toc-tdm.aspx

- RCEP Agreement Text. https://rcepsec.org/legal-text/

- USMCA Digital Trade Chapter. https://ustr.gov/…/united-states-mexico-canada-agreement

- ASEAN Digital Economy Framework Agreement. https://asean.org/asean-digital-economy-framework-agreement/

- African Union. Digital Transformation Strategy (2020–2030). https://au.int/en/documents/20200518/digital-transformation-strategy-africa-2020-2030

- European Commission. Digital Single Market Strategy (2015). https://digital-strategy.ec.europa.eu/en/policies/digital-single-market

- Cross-border Consumer Enforcement Framework. https://www.icpen.org/

- ODR & E-commerce Regulation. https://unctad.org/topic/e-commerce-and-digital-economy

- UNCTAD. Digital Economy Report 2022: Value Creation and Capture. Geneva: UNCTAD; 2022. https://unctad.org/publication/digital-economy-report-2022